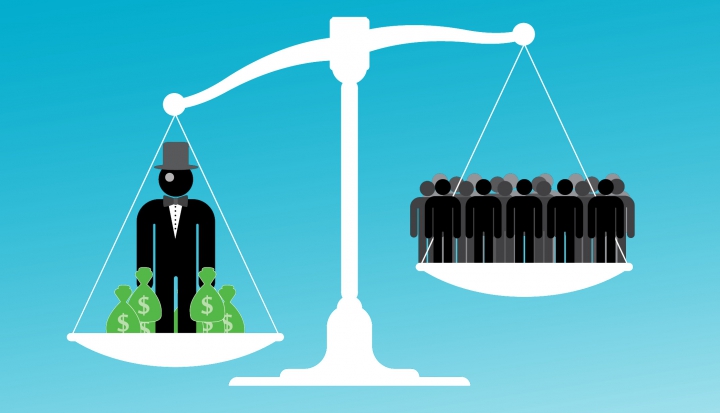

In the May 2015 issue of U.S. Catholic, Anthony Walton’s article, “When the rich get richer: The dangerous economics of inequality,” cited statistics quoted by Federal Reserve Bank Board Chair Janet Yellen in a 2014 speech. These statistics came from the 2013 Survey of Consumer Finances, a study conducted every three years that collects detailed information about income, wealth, and debt from 6,000 representative families. A dive into several of the specific statistics can reveal much about the widening equality gap in the United States.

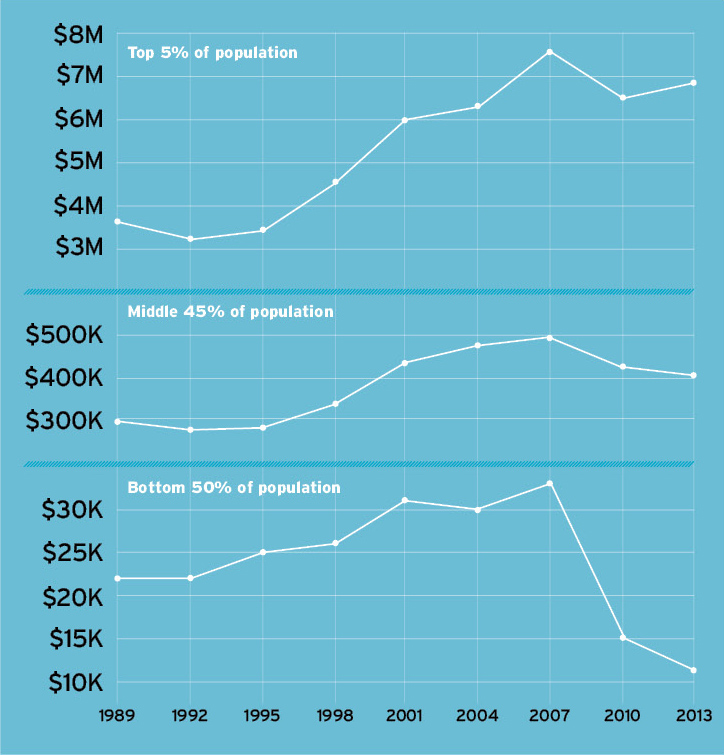

The poor get poorer

A grim portrait of the widening U.S. wealth gap: The average net worth of individuals in the bottom 50 percent in 2013 was $11,000, a quarter of whom reported zero or negative net worth; the average wealth of individuals in the top 5 percent, meanwhile, has nearly doubled since 1989.

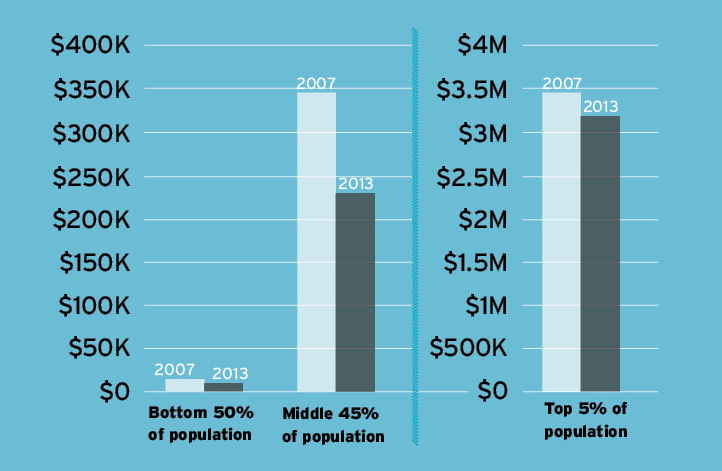

Families with kids are getting socked

The median wealth for families with children in the lower 50 percent fell from $13,000 in 2007 to $8,000 in 2013—after adjusting for inflation, that’s a loss of 40 percent. The middle 45 percent of families with children also lost wealth but had far more to start with, and the losses of the top 5 percent are small by comparison.

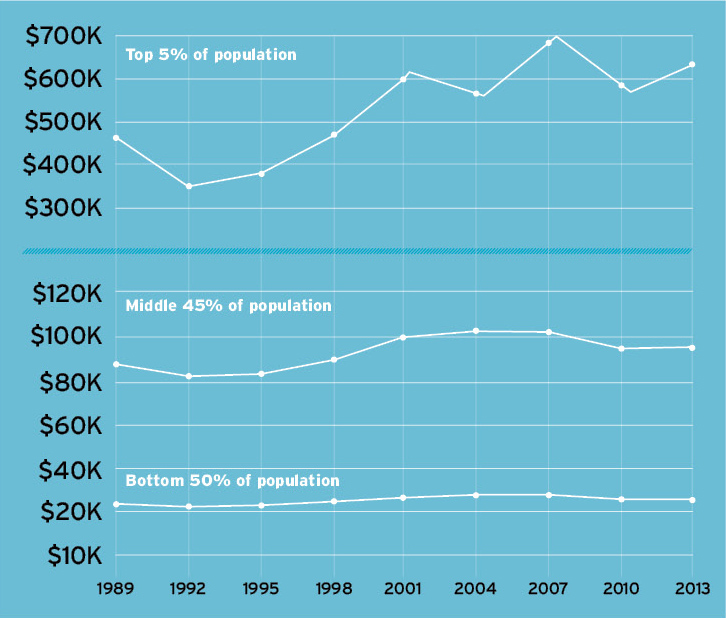

The gap keeps widening

The average income of the top 5 percent grew by 38 percent from 1989 to 2013, when adjusted for inflation, while the average real income of the other 95 percent of the population grew less than 10 percent, says Yellen. While everyone lost income during the Great Recession, here’s how the income of the top 5 percent has bounced back, compared to the flat growth for the other 95 percent of us.

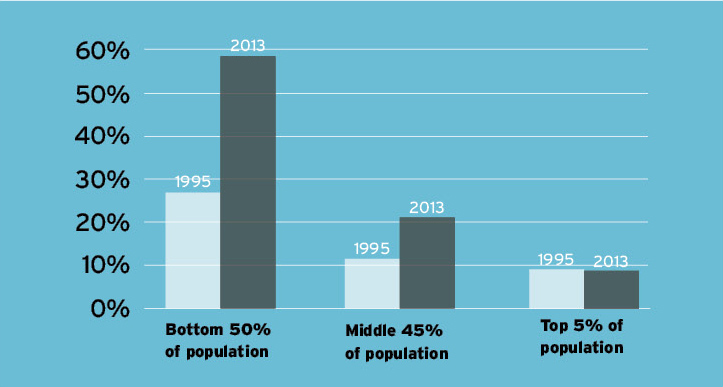

And don’t forget the college debt crisis

For the bottom 50 percent of households, from 1995 to 2013, education debt owed grew from 26 percent of average yearly income to a whopping 58 percent. The next 45 percent of households also faced more debt but in much lower amounts, and the top 5 percent saw no growth at all in college debt.

This is a web-only sidebar which accompanies “When the rich get richer,” that appeared in the May 2015 issue of U.S. Catholic (Vol. 80, No. 5, pages 12-17).

Graphics by Angela Cox

Add comment